Rivalry has belatedly launched its monetary outcomes for Q1, and whereas the esports-first bookie says it’s pleased with its progress, among the firm’s strikes have confirmed controversial.

After months of hypothesis, the Toronto-based betting platform has lastly revealed its efficiency throughout the first monetary quarter of the yr. Its biggest achievement is a predicted 58% discount in working prices in comparison with 2024. An elevated web income of $1.3 million has additionally helped convey it nearer to profitability. Nonetheless, these enhancements have come on the expense of constructing esports a decrease precedence. That leaves some fearful that it may very well be alienating its authentic core viewers.

The present buying and selling worth for Rivalry Corp. (RVLY.V) stands at $0.07 USD per share, far beneath its authentic launch worth of $2.35. Share costs suffered an 80% decline final October and have by no means recovered out of penny inventory territory.

(Picture credit score: Rivalry Corp.)

Buyers appear ambivalent concerning the firm’s numbers. Following the Q1 launch, Rivalry’s inventory briefly fell to simply $0.04 in pre-market buying and selling, however bounced again to its former worth in common buying and selling on July 17.

Whereas the corporate is inching nearer to profitability, it’s nonetheless burning capital. The issue is, because it pivots extra in the direction of typical bookmaking, it overlaps extra closely with different, better-established firms. Nonetheless, co-founder and CEO Steven Salz is optimistic about its long-term potential.

“This quarter marks the total emergence of Rivalry 2.0 – leaner, sharper, and structurally stronger… We’ve rebuilt the muse of the enterprise round high-efficiency acquisition, high-value customers, and a proprietary product – and we’re already seeing the affect,” mentioned Salz in the investor relations assertion.

Is Rivalry nonetheless an esports betting website?

Whereas Rivalry nonetheless touts esports as its major focus, the corporate’s transfer towards conventional sports activities betting and on line casino choices could also be pushing away its esports-centric base.

Rivalry initially launched in 2018 as a devoted esports betting website. It didn’t provide any conventional sports activities betting choices, not to mention on line casino video games. That was seen as a daring transfer in an area filled with conventional sports activities betting websites doing little to distinguish themselves and treating esports betting as an afterthought, in the event that they provided it in any respect.

(Picture credit score: Rivalry Corp.)

Rivalry’s standing as an esports-only betting website definitely differentiated it, but in addition put a ceiling on its potential consumer base. A number of partnerships with occasions and influencers helped bolster its popularity, and the positioning shortly turned a widely known title in aggressive gaming.

Early customers will recall that the unique URL led to .gg somewhat than .com, a reference to gamer slang that means “good sport.” It modified its area extension to .com in 2019, in search of to determine its legitimacy in an area rife with unregulated opponents, a lot of which additionally use .gg or .guess extensions.

Its technique continued to alter in 2022 with the addition of conventional sports activities, coinciding with modifications in Ontario’s playing legal guidelines to permit for on-line sports activities betting. On one hand, the addition allowed esports bettors to position bets on conventional sports activities without having to register with a separate operator. On the identical time, it diluted the model’s id as an esports-first oddsmaker. Later the identical yr, the corporate started including on line casino choices, beginning with a easy crash sport earlier than shifting on to slots, wheels, and different commonplace fare.

There’s little doubt that these different verticals have traditionally been extra worthwhile than esports betting. Nonetheless, making the product extra generic might have a adverse affect on new participant acquisition, particularly given the saturation of the traditional sports activities betting market.

Rivalry’s id seems to be converging with that of different playing websites. With out the esports-first hook it as soon as had, gamers may even see no cause to select Rivalry over a bigger competitor. Which means spending on bonuses, which might eat into the earnings Rivalry is hoping to see from these extra conventional verticals.

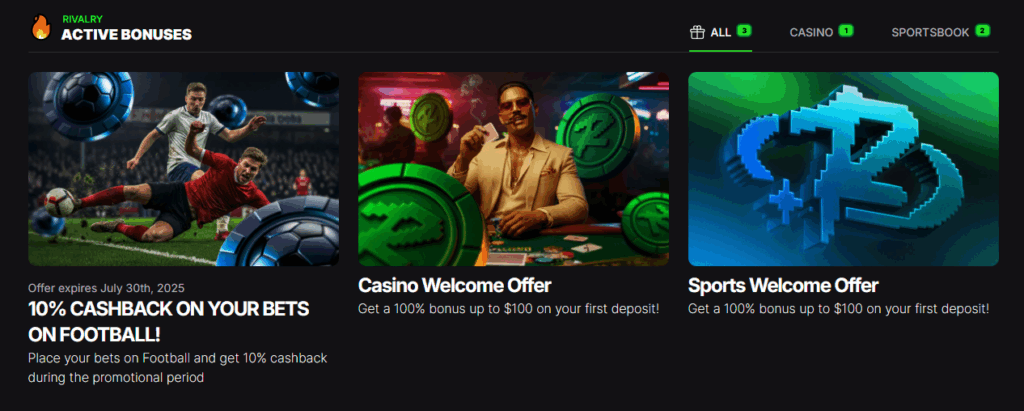

It’s value noting that on the time of writing, none of Rivalry’s present bonuses apply to esports.

(Picture credit score: Rivalry Corp.)

There’s maybe no clearer indication of Rivalry’s struggles than the a number of rounds of layoffs that started final yr in 2024. That included 29 misplaced jobs in July and 28 extra in October. Whereas shakeups are anticipated within the playing startup world, esports followers usually tend to be tuned in to the finer factors of the business in comparison with conventional sports activities followers.

The downsizing and lack of deal with esports might have slowed down buyer acquisition for the web site in 2025. Notably, Rivalry didn’t point out consumer acquisition wherever in its Q1 launch. Nonetheless, earnings are paramount for publicly traded companies. If the bookie is lastly in a position to cross over into the black, that may probably free its fingers to aim a comeback.